Last month, more than 12,000 delegates visited Miami for the 2021 Bitcoin Conference. This year’s event attracted six times more visitors than the 2019 event. In the presence of celebrities like Twitter and Square CEO Jack Dorsey, before libertarian icon Ron Paul, the question arises: “Have digital assets finally beome mature?”

Well, finally! Cryptocurrencies and digital assets have been around for more than a decade. Most people consider Bitcoin as a starting point.

Over the past five years, Bitcoin has gained popularity. The rally in 2017 has led to comparisons to some of the greatest asset bubbles in history. This chart, taken from an Economist article from January 2018, shows the bubbles of historical assets.

However, the price of Bitcoin has revived, and the second digital asset, Ether, has now captured more than a third of the market:

The total capitalization of the digital asset market, even after the recent correction, is $1.42 trillion. The crypto winter of 2018-2020 has been replaced by a more extensive and glorious summer, although the chart above suggests that autumn may have come along with the solstice this year.

In the three years since the first frenzy of speculation, many aspects of the digital asset market have changed. Regulators, eager to keep up, have begun to introduce controls aimed at protecting investors. Meanwhile, central bank leaders have announced the creation of their own digital assets – the Central Bank’s digital currencies (CBDC).

Last month, China, which was at the forefront of the development of CBDC, announced a ban on financial institutions and payment companies to provide services related to cryptocurrency transactions. They also warned investors against speculative trading in cryptocurrencies. The ban is not new, it is just an extension of the restrictions first introduced in 2017. Institutions are no longer allowed to accept digital currencies for payment or settlement, nor can they provide exchange services between cryptocurrencies and yuan or foreign currency. Savings, fiduciary collateral services and financial products related to cryptocurrency are also prohibited.

China’s actions should be viewed in a broader context. Worldwide, only five countries have declared digital currencies illegal, and only 15, including China, Russia and Canada, have imposed any restrictions on banking activities. Currently, there are no restrictions in India, but in the spring of 2021, a bill on cryptocurrency and regulation of the official digital currency was introduced to slow down adoption and protect investors. For unknown reasons, no action has been taken yet, but uncertainty remains. Therefore, it is encouraging to note that there are no restrictions in the EU or any G7 country, although environmental problems remain, especially in connection with the carbon footprint of Bitcoin.

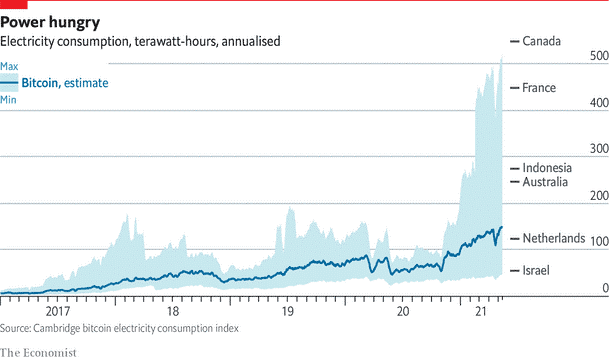

The mechanism that Bitcoin uses to verify transactions and issue new coins into circulation is known as” proof of work ” (POW). During periods of high activity, as it will be for most of 2021, Bitcoin burns more energy than the whole of Argentina. The obvious inefficiency of this process also explains why payments in BTC are slow and expensive, and therefore rare.

This has whetted the appetite for alternative mechanisms, the most popular of which is called “proof of stake” (POS). Ether, the second most popular cryptocurrency after Bitcoin, is preparing to switch to it, and smaller coins are already using it.

The recent correction in digital asset prices may be partly a response to the threat of a Chinese ban, but it is more likely due to a wave of profit-taking after exceptionally strong growth, fueled, at least in part, by monetary policy. and the fiscal pumping of central banks and governments in response to the economic shock associated with Covid.

Digital institutionalization

However, if we look not only at short-term fluctuations in cryptocurrency prices, the digital asset markets have expanded and deepened. A number of well-known organizations have invested in the sector. In June last year, a survey conducted by the crypto custodian Fidelity Digital Assets showed that 36% of institutional investors from the United States and Europe have already allocated space.

Hedge funds led the charge, but in December 2020, the insurance giant Massachusetts Mutual announced that it had allocated $100 million to Bitcoin. Meanwhile, Ruffer, the UK’s chief asset manager, announced the allocation of 550 million pounds.

Goldman Sachs will start offering its clients digital asset services. Rumors that they were going to enter the market back in May 2018 were quickly refuted with the beginning of Crypto Winter, however, since May 2021, they have been facilitating transactions with derivative financial instruments. Other major operators that are starting to offer products with digital assets include Cowen and Standard Chartered. Meanwhile, global custodian BNY Mellon has backed Fireblocks, a leading crypto custodian.

Although Bitcoin remains the largest digital asset by market capitalization, its performance this year is overshadowed by a growing circle of applicants. Now there are more than 80 digital assets with a market capitalization of more than $ 500 million. Of these, only nine showed low Bitcoin dynamics since the beginning of the year.

According tothe Coinmarketrate.com , a digital asset service provider, there are about 8036 coins and 476 recognized exchanges offering both spot services and derivatives. It is worth noting that the total volume of transactions with derivative financial instruments is usually higher than the volume of spot supply transactions. On a fairly average day, it exceeds $200 billion. To contribute to the sharp growth in institutional volume over the past year, exchanges and other technology providers have introduced a number of additional security services, including crypto storage, of which there are now more than 100 providers.

Asset managers quickly responded to the demand by offering a number of investment instruments. The simplest products, many of which are now available as exchange-traded funds on conventional exchanges, track individual coins or baskets of assets. One of the largest offers is Grayscale trusts, which provide new institutional investors with access through private placements. Their last reporting AUM (March 31) amounted to $40.3 billion.

Other investment products use a discretionary approach designed only for a long time, trying to provide a similar growth potential with less volatility. Then there are venture capital funds that invest in both coins and other digital assets, as well as in traditional private or public shares of many startups involved in the industry.

The last category is hedge funds that invest both long and short positions, using the opportunities to increase the value of assets and arbitrage, including inter-exchange arbitrage, basic trading between spot and derivative exchanges, and harvesting through asset lending programs.

There is an active market for borrowing and lending digital assets, and the available yield even for stablecoins, which is tied to the price of fiat currencies, can be significant.

The lack of pricing and variability between sites, as well as wide differences in the difference between the bid and the offer, is a clear indication of the nascent nature of the current market. However, in a world where the fiat interest rates for major world currencies fluctuate near the zero border, these interest rates are of interest.

Be careful, buyer, this is not a free offer: interest rates are a function of the demand for borrowed funds from market participants with a high share of borrowed funds and credit risk associated with various exchanges, platforms and technologies. During periods of high demand (usually when prices for digital assets are rising, and demand from borrowers is high), rates can skyrocket for a short time. The market is fragmented and inefficient, but the potential benefits are obvious.

There are more than 1,200 active hedge funds, most of which remain unregulated. The number of funds that closed after the previous bubble in 2017 is almost as large, but with the new bubble came new participants, many of whom are experienced financial market professionals looking for institutional clients. They create well-managed products designed to attract the discerning investor, and their attention is focused on risk management and drawdown control. What`s the goal? The best risk-adjusted return.

When did you think it was safe to return to space

Over the past month, the digital asset markets have reminded investors that something that is growing can fall even faster. Bitcoin as a medium of exchange remains too unstable for widespread distribution, as a means of saving it has its supporters, but for most investors it remains a highly speculative investment.

Leaving aside the instability of most digital assets, there are restrictions on adoption due to the decentralized and non-permissive nature of distributed ledger technologies. The transaction cost based on proof-of-work verification imposes a limit on the number of transactions that can be processed at a given time. Regardless of the carbon footprint, the current architecture remains limited.

Solutions are being prepared that will increase the speed and transaction capacity of the digital asset market. The constant flow of venture capital into the industry is a good omen for the future. Meanwhile, despite the bottlenecks mentioned above, the industry is rapidly becoming institutional in its approach. The leading participants generally welcomed regulation and supervision, as they give them official legitimacy.

A painful doubt remains. Why does any government voluntarily cede sovereignty over the issue of currency to its opponents?

Perhaps because the regulators have already shown their opinion. From the regulatory point of view, digital assets are considered as commodities (regulated by the CFTC) or securities (the scope of the SEC’s competence), none of them is considered an independent currency, even though officials discuss some of them, for example, Bitcoin.

China, along with other totalitarian regimes, may seek to outlaw their use, but the ban does not eradicate possession. He just drives him underground. In more open and developed democracies, digital assets will be increasingly regulated and legalized, but doubt remains.

This week, “BIS-CBDC: An Opportunity for the Monetary System ” provided an update on the benefits of CBDC. Among their findings, the remarks suggest that investors should exercise caution:

“Central banks are at the center of a rapid transformation of the financial sector and the payment system. Innovations such as cryptocurrencies, stablecoins and the walled ecosystems of large technologies, as a rule, work against the element of the public good that underlies the payment system…”

CBDCs represent a unique opportunity to develop a technologically advanced representation of central bank money that offers unique characteristics of finality, liquidity and integrity. But at the same time, this unique tool is able to drive the last nail into the coffin of cryptocurrencies, including Bitcoin, once and for all. Even despite its maturity.