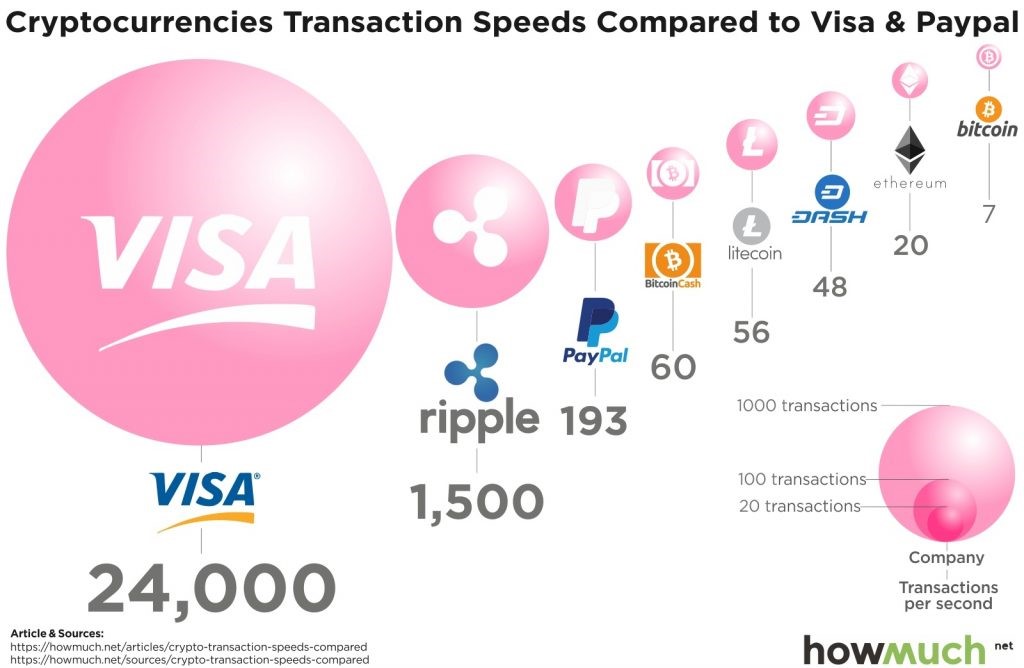

When it comes to comparing cryptocurrencies, many people use the number of transactions per second as a rating criterion. And comparisons with the VISA network are made very regularly. Since all the transactions at first glance are universal.

VISA and cryptocurrency comparison

Depending on the day and mood, we call the numbers: 56,000 and 24,000 transactions per second. That is, respectively, 4 838 400 000 2 073 600 000 transactions per day. Yes, you read it right: more than two billion financial transactions a day in one case and just under five billion in the other.

You will say that these numbers are not impossible, since there are approximately 7 billion 800 million people on the planet; however, the VISA network is not the only payment network on Earth, and many people use other payment methods.

The consequence is that in practice, since the number of people using the VISA network is not 7 billion, there are not 56,000 transactions per second, or even 24,000. According to VISA’s own website, the actual number of confirmed transactions per day is 150 million, which is an average of 1,736 transactions per second.

1,736 transactions per second is still much more than most cryptocurrencies are capable of.

At the same time, the VISA network is a centralized system with a fixed Commission for users (minimum amount + percentage of the transaction as a whole), regardless of whether 1000 or 4000 transactions per second. As for the confirmation speed, it remains about the same and fast enough for everyday use.

Is a comparison based only on transactions per second, which we often see on the Internet, reasonable?

To answer this question, we are going to look at numbers that are constantly repeated to us without understanding. And we will try to understand what makes the payment system a convenient payment system.

Theory and practice of transaction speed

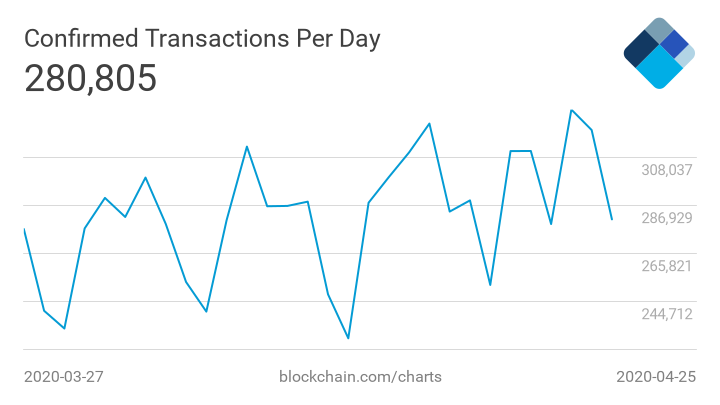

What exactly does this mean when it comes to cryptocurrencies and the number of transactions per second? In fact, this is a simple calculation of the mass of transfers processed per day, divided by the number of seconds per day. For example, for Bitcoin, over the past few days, there are about 300,000 transactions per day divided by 86,400 (the number of seconds per day), and we get 3.47 transactions per second. This is the current speed of the Bitcoin network in practice.

Speaking of theoretical maximums, you should act a little differently and calculate the maximum amount of data consumed by the network, the size of each transaction, the number of blocks processed per day, and so on. As a result, the theoretical maximum for Bitcoin is about 8 transactions per second. This article only discusses transactions made on the main bitcoin layer, and does not address solutions such as the Lightning Network.

The first thing we can do is that the Bitcoin network is not running at maximum capacity. By the way, so is the VISA network. And fortunately. However, it is already approaching 50% in a period that is not particularly stressful. What does this mean for the BTC?

To understand this, we must first think about what this maximum of transactions per second represents.

Imagine for a moment that you need to drive from point A to point B, and you have a choice of two road systems: one consists of multi-lane highways, and the other consists of a one-way country road. In a motorway system, a large number of people can move in different lanes at the same time, while on a country road, people can only move forward one by one.

Payment systems work similarly: when the maximum number of transactions per second is large, it means that many people can use the network at the same time. And when the maximum number of transactions per second is small enough, the number of simultaneous network users is reduced. Each transaction in the payment network actually corresponds to a vehicle in the road system.

Now back to BTC. Thus, the maximum throughput of the latter is 8 transactions per second, and on average we are already approaching half of this figure. Like a two-lane road, one of which is already full, Bitcoin is a network that cannot support many more users than it does today. And, unfortunately, current users of BTC do not represent half of the world’s population.

This means that the Bitcoin network (main layer) is currently incompatible with widespread use at the planetary level. But that’s not all: the maximum network bandwidth is not the only observable variable.

The transaction rate

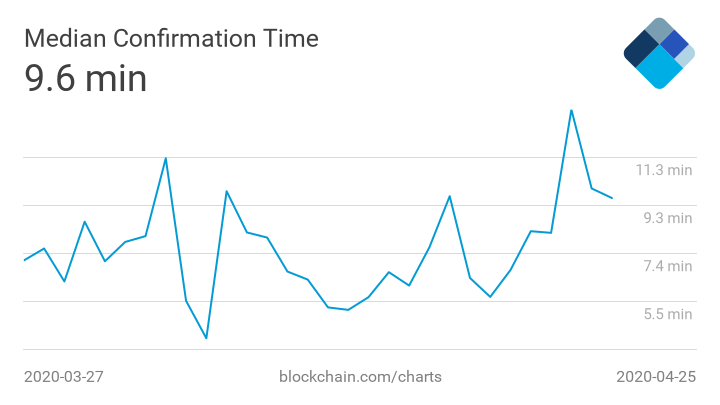

We will approach the problem from the other side and take into account data that is rarely used by fellow crypto journalists: the speed of transaction confirmation.

Let’s take the VISA network again for reference: due to its centralized nature and lack of cryptography similar to Bitcoin, transactions are confirmed almost instantly. When you go to the store’s checkout, the payment is confirmed immediately.

This can also be verified with cash: payment is confirmed when the banknote reaches the seller’s hand. So it’s literally instantaneous.

For cryptocurrencies, everything is a little different. Before a transaction can be confirmed, in most networks, a payment must be integrated into a block with other transactions, and then this block must be cryptographically certified. All this before it was released, and others released after it in large numbers, so that it could be considered unchanged. This is called “confirmations”. Each time a new block is released that does not affect the established order, the previous blocks are confirmed once.

The purpose of this mechanism is to certify the transaction in a secure way. This is because the older the block, the more difficult it is for an attacker to popularize a copy of a chain in which the block does not exist.

What is a double spending attack?

But a side effect rarely mentioned by bitcoin enthusiasts is that the practicality of BTC suffers greatly. Because several blocks are required to confirm a transaction, and a certain amount of time must pass for each block.

Now imagine that you are in a supermarket and you want to pay in BTC. The supermarket accepts, but like all modern exchange platforms, it confirms your purchase only after 6 payment confirmations. This means that you need to publish 6 blocks in order for your transaction to be considered unchanged, and you must wait for the sixth block to be published before leaving with your shopping bag.

In the case of Bitcoin, it takes about 10 minutes to publish a block. Therefore, you will have to wait about 60 minutes at the checkout for the payment to become irreversible.

A very long hour during which cash register may be unfit, broke, and just not be available for use by other customers, and you will have to put up with insipid background music and killer views of pensioners forced to go to the counter number three.

And this is a serious problem for a very large number of cryptocurrencies: transactions are often very slow to verify compared to traditional payment networks. Even without taking into account the maximum number of users, which is another obstacle to the introduction of cryptocurrencies, they are difficult to use on a daily basis, because we need to be able to pay almost instantly.

To use an analogy with a road system, a network that quickly confirms transactions is like a road with a speed limit of 200 km / h, while a network that slowly confirms them is approaching a road with a speed limit of 10 km/h. When you need to move, you will almost certainly choose a road that will allow you to go faster.

After the confirmation speed, the third characteristic of cryptocurrencies remains, which is very interesting compared to traditional systems.

Network transaction costs and scalability

The last criterion that most people forget to take into account is the cost of using the network. There are tolls on motorways, and transaction fees are charged on payment networks.

In the case of the VISA network, the fees are diverse and different, each of which corresponds to a specific part of the transaction. Therefore, they are variable, but this variability only concerns the type of service provided, not the network load. Regardless of whether the VISA network processes 1,000 or 10,000 transactions on that day, you will pay the same amount for each one.

In the context of blockchain, everything is a little different. In most networks, such as Bitcoin, miners have the option to select a transaction to make, and users have the option to choose which payment to offer to the miners. From here, among the miners, the race for the most profitable deals begins.

What happens when the network fills up? The miners will be simultaneously bouncers of Nightclubs and managers of the auctions. They will decide who can confirm their transaction based on the prices everyone is willing to pay.

So let’s go back to the road analogy: imagine two road systems of the same quality, with the same restrictions that have reached their maximum capacity, and with a toll at the entrance to each.

In the first system, the toll is automatic and calculates the toll for using the road according to the type of vehicle used. Regardless of traffic, if you have a sedan, you pay one hundred rubles, and if you have a semi-trailer, you pay two hundred rubles. Thus, users wait at the collection point and go through the procedure in the order in which they arrived. For a long time, but honestly.

On the other hand, the tolling system is run by people, and they only let in drivers who are willing to pay more than others. Thus, the rich are allowed to pass if they agree to leave a few thousand rubles as a fee, while the poor are not allowed to enter and sent home. This is unfair, and prevents some from doing their job.

As you may have guessed, VISA is more like the first fare, and blockchain is more like the second.

However, it is important to emphasize one thing: this problem situation occurs only when the network is saturated. Let’s say there is a copy of Bitcoin that is identical in every way to the version we know, except that the network can process hundreds of billions of transactions a day. Of course, the network will never be overloaded, and as a result, miners will not sort transactions that will all be verified (although more profitable transactions will be verified a little faster). Anyone can use the network, and transaction costs will remain low enough that the network can be used on a daily basis.

Unfortunately, current networks are often too limited in the maximum number of transactions per second, and so this leads to network usage costs that tend to explode during peak hours. . We saw this in 2017 with both Bitcoin and Ethereum, and we will definitely see it again, whether in a month or five years.

Comparison of different cryptocurrency networks

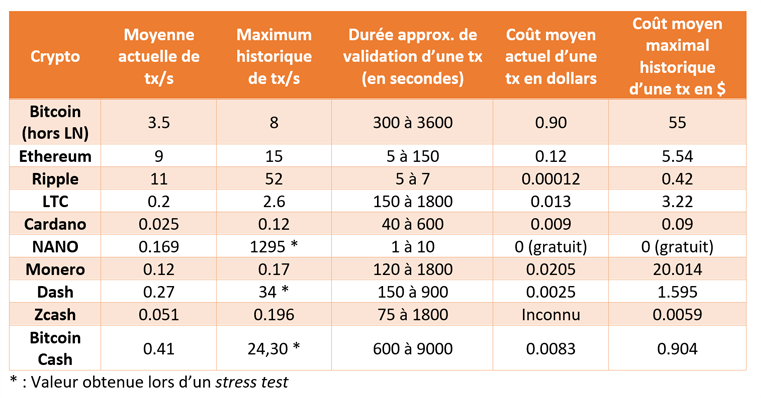

Now that you understand the various characteristics of the network in terms of speed, it’s time to make a comparison between several more or less well-known cryptocurrencies.

However, before you read the table, I would like to point out that these statistics come from various more or less accurate and reliable sources. In particular, as for the duration of the transaction verification, which also largely depends on the choice made by the person receiving the payments (we can consider the transaction confirmed after 1 block or after 20 blocks).

And another thing that is important to mention is that here we are only talking about the first level of each network. Some networks are implementing alternative solutions to overcome their shortcomings, such as the Bitcoin Lightning Network.

So, here is a comparative table of the speed of cryptocurrencies:

As you have seen, the number of transactions is now extremely small for most cryptocurrencies and not much higher for those that are among the top three in the market capitalization rating. Whether it’s three and a half, nine or eleven transactions per second, we are far from the usual 1,700 transactions per second for VISA. These figures show how much cryptocurrency is still unknown to the public.

When it comes to maximum network speed, the NANO is the only one who can vaguely claim that it can handle VISA, but in speed testing, it only reaches two-thirds of the VISA network’s cruising speed. Thus, there is still a lot of work to be done in this direction before cryptocurrency replaces traditional systems.

Conclusion

Thus, you understand that existing networks, in addition to insufficient speed, suffer from too much increase in costs in the event of network congestion. These elements tend to prove that cryptocurrencies are still far from traditional networks, and that it will take a lot of work to come up with something comparable.

But we don’t lose hope: progress is slow but steady, and some cryptocurrencies will eventually achieve the same performance as the famous VISA system. It’s a matter of time. Ethereum, for example, will soon see a number of changes, such as segmentation or share confirmation, and the maximum number of transactions per second is expected to increase significantly with this.

Last but not least, you must remember that speed is not everything. Decentralization, resistance to censorship, security, and anonymity are also of paramount importance for cryptocurrency to cope with existing banking networks. This is, of course, data that is impossible to quantify and therefore very difficult to compare, but you should at least try to take them into account when comparing cryptocurrencies. Especially since cryptocurrencies that have chosen speed often sacrifice security or decentralization to achieve this.