Where will the EOS price go in 2021? What will happen to its pricing policy? Since cryptocurrencies are decentralized, crypto investors have always wondered: what drives the price of EOS.

Analytical overview of the future price movement of EOS

EOS has been in the sights of many investors since around altcoin, and its platform EOS.IO there was constant hype. The hype started with the initial coin offering. The first ICO lasted almost a year, which is one of the longest in the industry. It was not only the longest, but also brought in a record $ 4 billion. This outstanding performance the ICO is almost instantly attracted the attention of the asset.

It is important to consider whether EOS has lived up to its reputation. Although it is difficult to find a definite answer to this question of whether it is a good investment, one way to answer it is to determine the factors that affect the price of the coin.

What drives the EOS price? The value of an asset is determined by three factors:

- Network development

- The cryptocurrency market

- Increased acceptance

The EOSIO platform is a new generation open source Protocol. The vision is to create a decentralized blockchain with lightning-fast transaction processing speed, and virtually no transaction fees. The main focus of the platform is on smart contracts that will allow the release of decentralized applications.

The world is rapidly moving towards digitization, and cryptocurrencies are striving to provide speed and flexibility for users, but not many have succeeded. EOS has taken the goal to a new level, as it aims to be able to process a million transactions per second.

If this happens, it could significantly accelerate the development of the cryptocurrency industry. The project also aims to increase the usability of smart contracts by offering basic features built into its platform that not only increase speed, but also simplify work.

EOS has a lot in common with the Queen of cryptocurrencies – Ethereum, and not only includes some of its distinctive features, but also focuses on the gaps that exist in Ethereum. For this reason, lead developer Daniel Larimar called EOS The “Ethereum killer”. Larimar also said that EOS has the strongest yet infrastructure for decentralized applications.

The main difference between Ethereum and EOS is the consensus mechanism. Ethereum uses Proof of Stake (PoS), whereas EOS has a Delegated Proof of Stake (DPoS) mechanism. DPoS allows you to save time, since regular mining is not required. EOS is more efficient when processing transactions. Ethereum can process 15 transactions per second, while EOS processes a whopping 1,000 transactions per second, and targets even more – 1 million.

Hence, EOS scales well. Miners, or rather validators, are chosen not because of the number of tokens they have, but rather as part of a more democratic process.

What makes EOS different from other cryptocurrencies

EOS can be seen as a very ambitious cryptocurrency. It was launched on January 18, 2018, and is currently under development. The attention and support that the company has received in such a short time is impressive. It could also be an indication of the hype that EOS can create after being fully developed.

EOS, in fact, works the same way as all cryptocurrencies, as a payment system. According to CoinList, this system has outperformed major credit cards like Visa when it comes to processing transactions. EOS also has a lot in common with Ethereum, although EOS takes things to another level.

EOS can process a large number of transactions without any additional fees. This is achieved through a unique mechanism similar to that of Ethereum. Block producers are paid by the blockchain, and therefore all additional fees are eliminated. Another feature that helps the structure maintain balance is the level of inflation.

Two squares are created sequentially in the block chain. But only one block producer can create a block at one point. These limitations ensure that the platform works at an ideal level. A block producer that is unable to deliver any blocks within the designated time period is briefly removed from the network to ensure efficiency.

The EOS network can also be used by organizations to mine or store data. It also has available storage and server hosting features that will definitely help ease of use and build decentralized applications.

Since one of the goals of the project is to expand the use of blockchain technology, the EOS network is also characterized by ease of use. The platform is easy to use and relatively simple.

What drives the EOS price?

A predicting the price of cryptocurrency is a very complicated matter. Often, not a few factors come into play, but many. It becomes difficult to differentiate and analyze which factors are more important. But since price prediction is of paramount importance to investors, here’s a look at the main factors that play a role in determining the value of EOS.

3 factors affecting the price:

- Factor 1: network Development

The concept of the EOS network attracted a lot of people to it. This is one of the reasons why the altcoin was so successful in its initial coin offering. What he seeks to achieve attracts many. However, the network is not yet fully developed. While EOS has delivered on some of its promises, offering huge scalability and virtually no cost, it remains to be seen how much of all the promises will actually come true.

- Factor 2: the cryptocurrency market

In any market, prices are determined where supply and demand meet. An increase in supply leads to lower prices, while increased demand leads to growth. But the cryptocurrency market is a bit unique. Usually, the supply of cryptocurrencies is strictly limited. Therefore, supply does not play a decisive role in setting prices. Demand remains. The demand for cryptocurrency is the most important factor in determining the price, since the value of cryptocurrency depends on the consumer’s perception. Cryptocurrencies are becoming increasingly popular. This will naturally increase the value of cryptocurrencies.

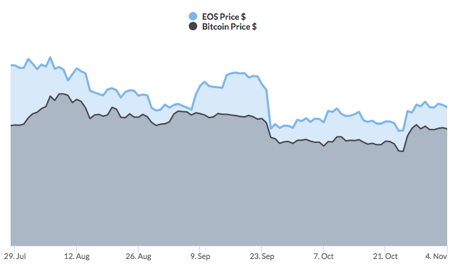

In the cryptocurrency market, Bitcoin plays a huge role. Bitcoin as the king of cryptocurrencies strongly affects the prices of other crypto assets. As the industry witnessed the boom of 2017, cryptocurrencies tend to follow the PTS. EOS has a correlation coefficient of 0.83 with it. This means that any changes in the value of Bitcoin will greatly affect the price of EOS.

Correlation of Bitcoin and EOS prices

EOS also faces serious competition from Ethereum. This competition poses a threat to the price of the crypto asset, as Ether is one of the original coins and has a mainstay in the market. Only time will tell if EOS can defeat the Queen, or succumb to her power.

- Factor 3: more intensive implementation of the

EOS ‘ vision is to make blockchain technology accessible to everyone and make it easier to use. With this in mind, EOS was developed and is currently being developed for mass adoption. Scalability is one of its distinguishing features, as EOS aims to process a million transactions in one second.

The project is suitable as a digital payment platform. It also aims to encourage the use of blockchain technology through smart contracts and decentralized applications. We have also seen an increase in the adoption of cryptocurrencies, and as EOS gets closer to realizing its vision, we may see an increase in its adoption. With wider adoption, the perceived value of the coin will increase, leading to an increase in its price.

Price forecast for EOS

Currently, EOS is ranked 16th in the cryptocurrency market with a market capitalization of $ 2,507,955,213. It has about 940 million altcoins in circulation and a hard capitalization of 1 billion tokens. The current price of EOS is $ 3.10. EOS reached a peak in 2020 at around 2.6 dollars.

EOS market cap, volume and price

The founder, Daniel Larimer, is also a co-founder of Steemit and BitShares, and many positive reviews around EOS can be attributed to Larimer’s good reputation in the cryptocurrency world. This has also been a source of optimistic future for altcoins.

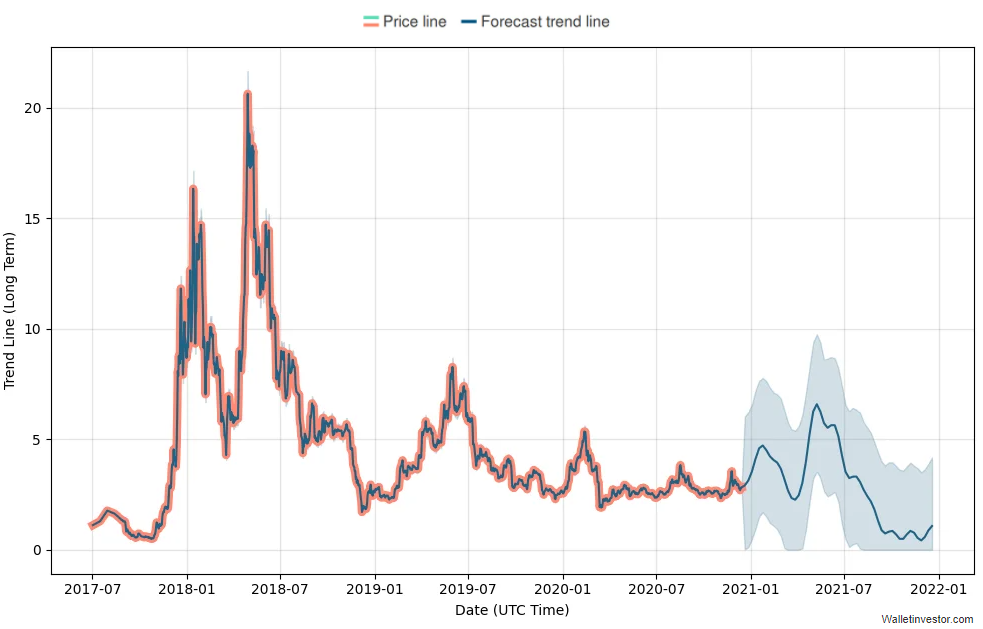

EOS price forecast from Wallet Investor

According to Wallet Investor, EOS will have big swings in the new year. It is expected that in the first few months of the new year, the peak will be around $ 5, but in the worst case, the asset may fall below the $ 1 mark. Wallet Investor also predicted that EOS could experience a negative change of about 64% in the near future, and could fall to $ 1.103.

Price forecast by Coinliker.com very optimistic. The short-term price forecast shows a negative change of 10%, but the coin can be a good long-term investment. With the EOS network still under development, the long-term Outlook is encouraging as the network is expected to complete its development soon.

Five-year price forecast

Overall, the overall mood of the EOS market seems bullish, which may indicate that the crypto asset may grow in the future. Other factors, such as a growing community, increased acceptance, etc., will also play a vital role in driving up the price of this popular cryptocurrency.