[vc_row][vc_column][vc_paragraph text=”A new document specifying the requirements and recommendations for technological systems of managing and storing digital assets was published by Crypto Valley experts.“][/vc_column][/vc_row][vc_row][vc_column][vc_heading title=”Innovation basis for crypto industry” size=”medium”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”Capital Markets and Technology Association, CMTA, is an independent association that unites experts in the fields of technology, finance, auditing and law who aim to bring new technologies to the capital market.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”Association is based in Switzerland that is a crypto friendly jurisdiction often called the Crypto Valley. As at middle of 2019, Crypto Valley hosted over 800 companies dealing with blockchain or digital currencies with more than 4000 of employees.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”CMTA has recently issued a project that focuses on specific recommendations for technological systems of crypto assets’ storage and management. It was first published on 30 April 2020.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”Fedor Poskryakov, the Secretary General and CMTA‘s partner at Lenz & Staehelin, claimed that was the first initiative of the Swiss financial industry on developing a common standard for crypto storage and management.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”He said, “The digitalization of the markets infrastructure is speeding up. In this context the implementation of “Digital assets storage standard” (DACS) represents an important stage. Benefits of digitalization are so obvious that the evolution towards decentralized infrastructure seems inevitable”.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”DACS seeks to ensure the high level of guarantees for digital currencies’ holders without impeding neither business owners no the conveniences provided by storage systems.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=” “There are some aspects of storage that contradict the utilization standards and the security measures associated with safeguarding traditional financial resources”, says the document.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”These peculiarities create a number of difficulties, and the most significant of them touch the ways of creation, utilization and protection of private keys over the life cycle of custody services.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”DACS wants to establish the basic level that can define some guarantees for both clients and auditors. The basic standards are intended to allow them to evaluate a decision about a deposit or a supplier.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”To this end, the recommendations are formulated in a way which would make it possible to consult but not to depend on their implementation.”][/vc_column][/vc_row][vc_row][vc_column][vc_heading title=”Crypto-integration tools” size=”medium”][/vc_column][/vc_row][vc_row][vc_column][vc_single_image image=”1511″ img_size=”full”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”As the document states, banks and other financial institutions can use the solutions for autonomous storage, and according to them technological solutions will be monitored by a special tool for managing several accounts within a digital ledger (‘DLA’).”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”The described DLA can be handled in accordance with various models. Each of the models is accompanied by a detailed list of recommendations from the periodic security revisions to document handling and managing the leading cryptos.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”Choosing the concrete depositing model can also has far-reaching consequences depending on types of coins and the regulatory status of holder.”][/vc_column][/vc_row][vc_row][vc_column][vc_paragraph text=”Jean-Philippe Aumasson, chairman of the Technological CMTA Comittee and Taurus Group co-founder, notes, “DACS will lead to greater maturity in the technological and procedural aspects of crypto storage. Leading audit firms, suppliers of depository solutions and the controlled financial organizations have joined their efforts to speed the financial industry evolution towards creating a decentralized infrastructure”.”][/vc_column][/vc_row]

Without rubric

YouTube says no to cryptocurrencies

So far, YouTube has had a strange relationship with the crypto industry. The platform continues to ban videos related to ...

Analytics

What is the crypto market correction?

A market correction can occur in any financial market. Thus, not only in the cryptocurrency market, but also, for example, ...

Analytics

Bitcoin, and the correlation with financial markets

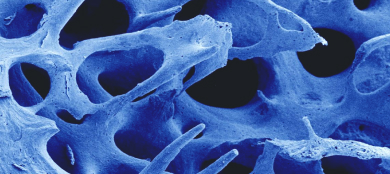

In March 2020, financial markets experienced a tumultuous roller coaster. If you log on to Coinmarketrate.com then you will be ...